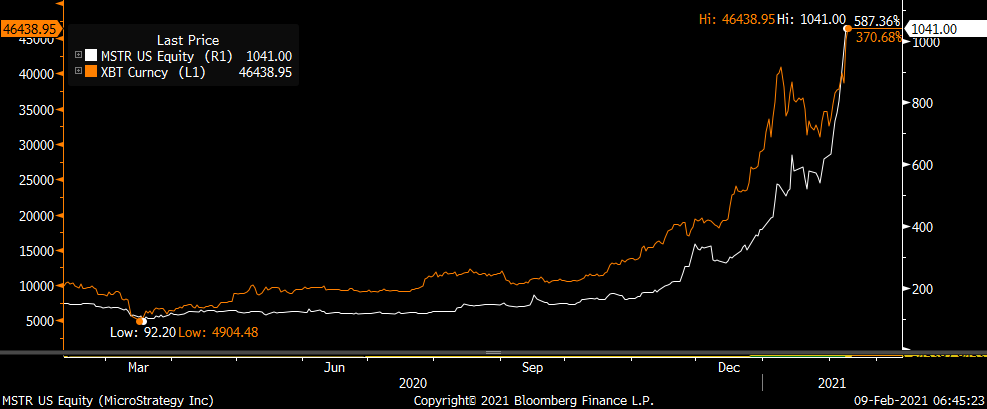

So with now Tesla taking the Bitcoin plunge, if more companies follow it and MicroStrategy we will be creating a closer connection between Bitcoin and the stock market. Not that we should because with the case of Tesla, its $1.5b position in Bitcoin is a tiny fraction of its $828b market cap but at least from a perception standpoint it could be the case. With MicroStrategy, it is now essentially a bitcoin stock as its core fundamental business is now a sideshow. See the chart.

Bitcoin in orange, MSTR in white

One wonders if there is a shift by some corporate treasurers (because many definitely won’t) to hold something other than dollars whether it results in some self introspection on the part of the Federal Reserve as to why this is taking place. Why don’t they want to hold dollars? Why are they willing to risk corporate cash in an asset that is only 13 years and not the paper our own government issues. Because they don’t believe in its use as a store of value? Tesla did say they could also buy gold and silver.

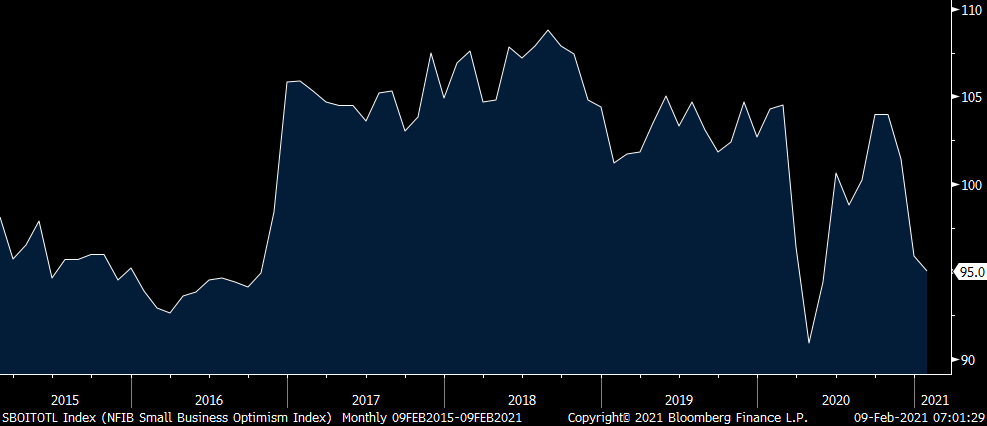

The NFIB small business optimism index fell again to 95 from 95.9 and that is the weakest since May when it printed 94.4. Plans To Hire was unchanged but at the lowest since June. Capital spending was also unchanged but at the lowest since May. There was further weakness in those that Expect a Better Economy and Higher Sales and no change in those that said it’s a Good Time to Expand. There was no change in inventory plans at the lowest since May. The Compensation components both rose m/o/m after the prior months drop while there was a 1 pt rise in job openings. Those expecting Higher Selling Prices rose 1 pt after declining by 2 pts last month off the highest level since May 2018. As for the earnings outlook, it deteriorated for a 3rd month to a 5 month low.

The NFIB said “The Covid-19 pandemic continues to dictate how small businesses operate and owners are worried about future business conditions and sales.” It’s easy for the rest of us to say, ‘all is good, the vaccine is here’ but it is these small businesses that have to deal with the difficult here and now before reaping the benefits of the vaccine which won’t be realized for many months to come.

NFIB

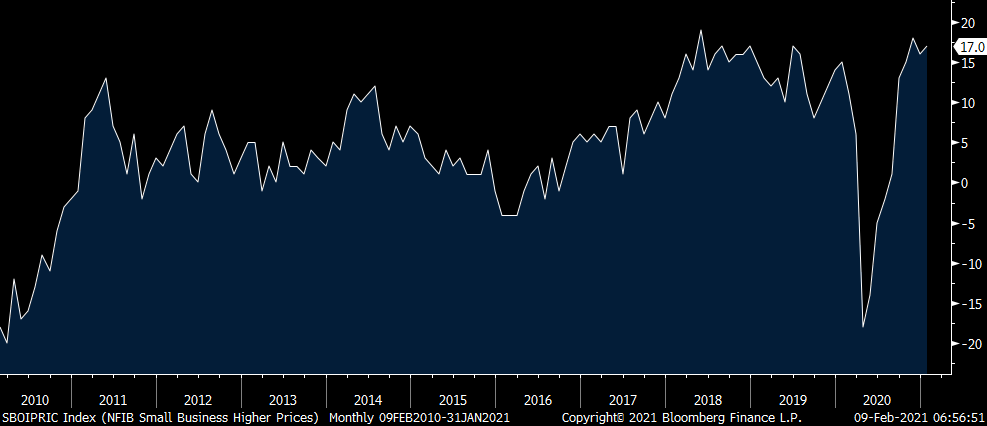

NFIB – Higher Prices

Ahead of the Lunar New Year, there was a sharp rise in financing extended in China in January as is seasonally typical. It came in at 5.17 Trillion, above the estimate of 4.6 Trillion with 3.58 Trillion of that being bank loans. There was a sharp increase in loans to non financial companies and households. The contrast to this lending jump was a smaller than expected increase in M2 money supply of 9.4% vs 10.1% in December and vs the estimate of up 10% as the PBOC has tried to reign in credit growth, acknowledging the desire not to overheat, particularly in their financial markets according to PBOC officials. We’ve also seen a string of corporate bankruptcies which I view as a good thing as it cleanses the decks of troubled companies rather than feeling the need to bail out. The data came out after the Chinese stock market close but the yuan is higher along with most currencies vs the dollar today.

Bloomberg news has a story that the Bank of Japan “is reluctant to scrap its targets for stock fund purchases at its policy review next month as it could give the impression it is dialing back its stimulus, according to the people familiar with the matter.” This is the problem, central banks once they go down another path of easing, they find it impossible to get out without threatening to pop the bubbles that their buying creates.

To this, the US Barclays corporate high yield index is now yielding less than 4% at 3.96% (yield to worst). There is still yield for junk but no longer high.

US HIGH YIELD

German exports were little changed in December, rising .1% from November but that was better than the estimate of down .6%. The German export dependent economy has benefited from its strong manufacturing base and demand from China. The key now though is their important auto sector and how long production is disrupted by the lack of semiconductor chips. The euro is higher for a 3rd day, back at $1.21. After the sell off in European sovereign bonds over the past few days, yields are little changed today.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.