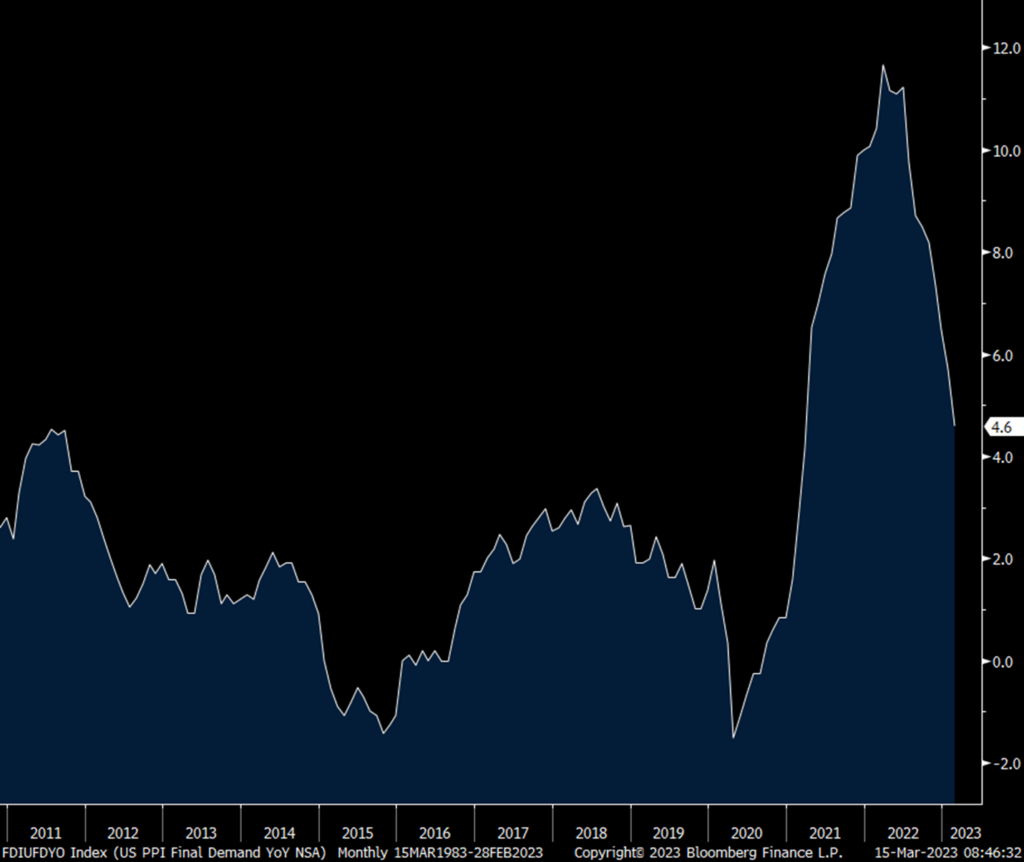

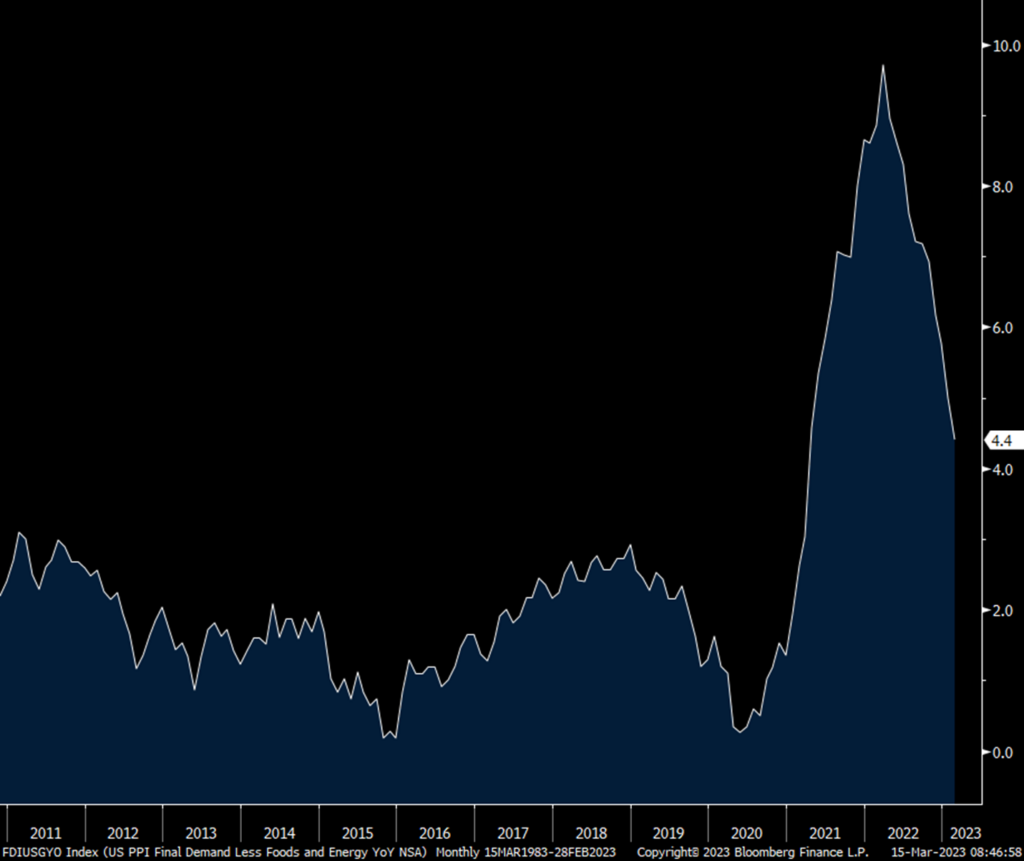

February PPI fell one tenth headline unexpectedly as the estimate was for up 3 tenths. And, this comes off a downward revision of 4 tenths to January to up 3 tenths. The core rate was flat m/o/m instead of rising by .4% as forecasted and January was revised lower by 4 tenths. The y/o/y headline gain slowed to 4.6% from 5.7% last month. The core rate was higher by 4.4% vs 5% in January.

The drag on goods prices was mostly due to lower food (falling egg prices) and energy prices m/o/m as ex this, goods prices rose .3% m/o/m and 5.2% y/o/y. Steel prices in particular jumped almost 11%. With respect to services, they fell for a 2nd month by one tenth while up 3.8% y/o/y. Machinery and vehicle wholesaling led the decline but also fell for chemical wholesaling, auto/parts retailing and airline passenger services. Prices rose for food retailing and financial services.

Bottom line, as CPI has been seen, PPI doesn’t really move markets but today’s data does reflect the continued deceleration in wholesale prices. Prices in the pipeline were mixed. As for the Fed, even if the Fed does raise by 25 bps next week, which I think they will, at this point it will just be symbolic as they are about done. The question then is what happens with QT from here and I think it’s imperative for the Fed to start giving some details on where they want to take it.

With this data point, economic worries via likely credit contraction from here (and terrible NY mfr’g survey) combined with the drop in energy prices today has the 5 yr inflation breakeven down by 10 bps to 2.32%. Rate hike odds for next week are now down to 56%.

PPI y/o/y

Core PPI

The March NY manufacturing index fell to -24.6 from -5.8 and is below zero for the 7th month in the past 8. New orders and backlogs remained in contraction. Notably too was the pick up in the Employment decline to -10.1 from -6.6 and the 4th straight month of drops in the workweek. Inventories went negative too. Prices paid and received fell again m/o/m.

The 6 month outlook fell to 2.9 from 14.7 with capital spending plans softening again. Tech spending plans did lift by 3 pts but after falling by 7 last month.

The bottom line is that the manufacturing recession, ongoing for 4 months as measured by the ISM and S&P Global figures, has likely continued on in March.

NY Mfr’g

Retail sales in February, somewhat of a lost month in that it’s post holiday sales in November and December and gift card uses and returns in January, was a bit better than expected. Core sales grew by .5% m/o/m, much better than the estimate of down .3% and January was revised up by 6 tenths. Auto sales though declined by 1.8% m/o/m but after a jump of 7.1% in January. Building material sales fell by .1% m/o/m. We also saw sales declines in furniture, clothing, department stores (after the 18% spike in January) and at restaurant/bars. Sales rose for online retailers, electronics and for non-discretionary food/beverage and health/beauty.

Bottom line, sales ex gasoline stations fell .4% m/o/m while still up 6.1% y/o/y. As seen above, the month was really a mixed bag in terms of the breadth of sales. These too are all nominal numbers and sales are still running about even with inflation so on a REAL basis, sales are rising only slightly.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.