The January ISM services index rebounded to 55.2 from 49.2 and that was well better than the estimate of 50.5. New orders bounced to 60.4 from 45.2 while backlogs were up slightly at 52.9. Inventory remains below 50 but did tick up by 4.1 pts m/o/m to 49.2. Notwithstanding the BLS report, the Employment component was smack on 50 from 49.6 in the month before. Supplier deliveries rose 1.5 pts to also at 50 while prices paid was little changed at a still high 67.8.

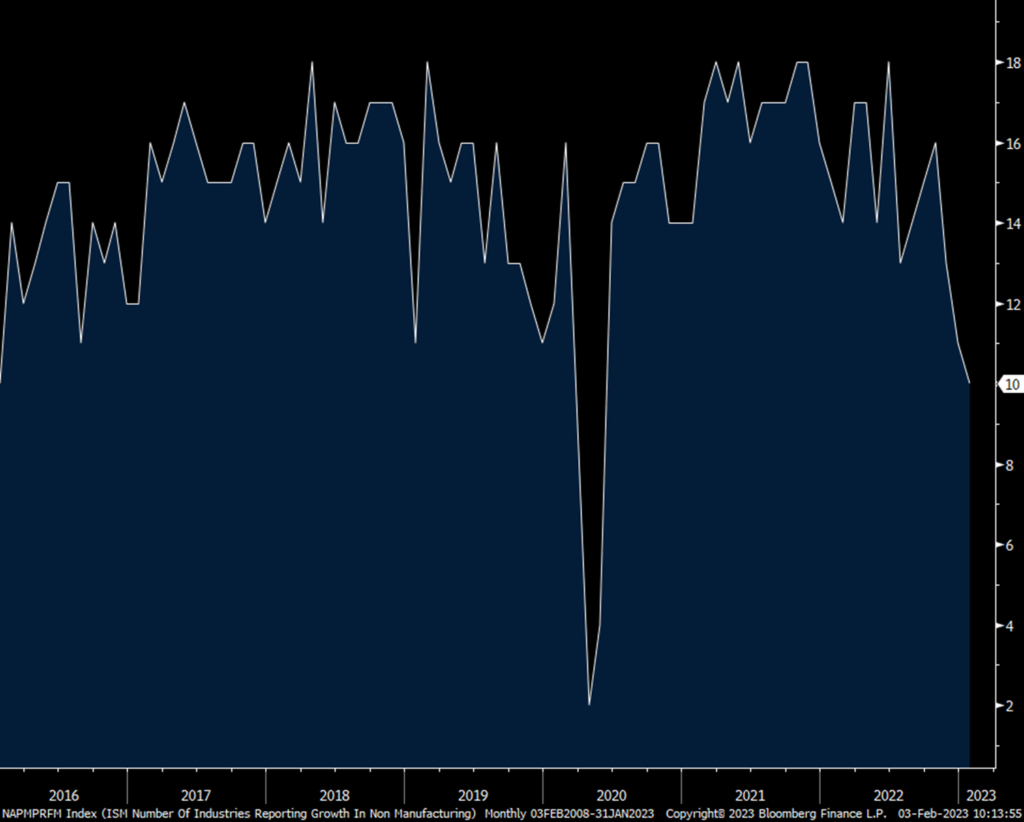

While ISM services was higher m/o/m, the breadth weakened as just 10 industries saw growth vs 11 in December, 13 in November and 16 in October. That is the smallest amount since 2016 not including covid. Eight industries are contracting.

A bit more on employment here on the heels of the blow out (but with population adjustment influences now being revealed that likely skewed everything) jobs report, ISM said this, “Comments from respondents include: ‘Unable to hire qualified labor – supply is thin’ and ‘We continue to let people go, not replacing any open positions.”

In contrast to ISM, S&P Global’s US services PMI includes small and medium sized businesses and also takes out ag, mining, utilities, construction, wholesale, retail and government. Their services PMI was 46.8 in January, below 50 for the 7th straight month. They said “The downturn is being led by a slump in financial services activity, linked in turn to higher borrowing costs, with consumer facing service providers also reporting especially tough business conditions amid the ongoing squeeze in spending due to the rising cost of living.” On the employment side and quite a different read from what the BLS said, “Hiring has almost ground to a halt as firms reassess their payroll needs in light of the weaker demand environment.”

Bottom line, while ISM’s report did show improvement, only about half of the industries are seeing growth with the rest contracting and the S&P Global report remains pretty weak. As for the BLS report, its seems that whatever population adjustments they made played havoc with the reported data.

Number of service industries seeing growth

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.