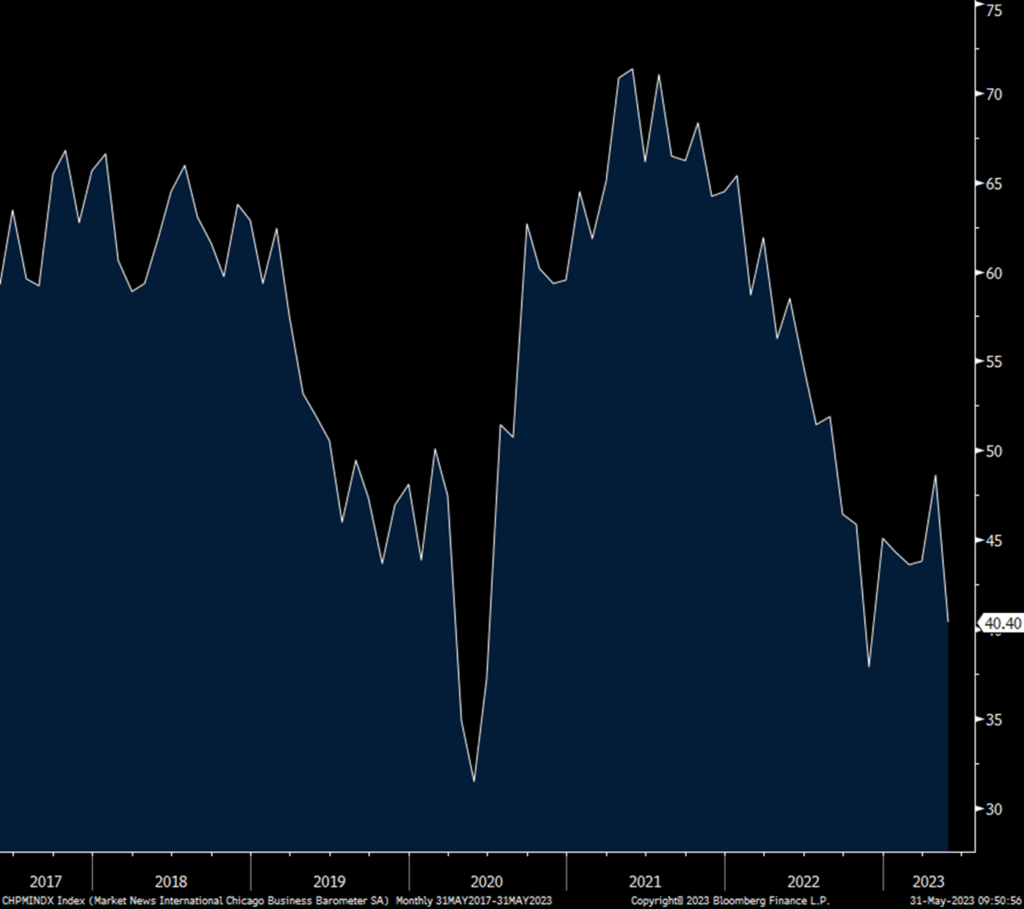

After yesterday’s deeply negative Dallas manufacturing survey which followed negative prints from NY, Philly, KC and Richmond, today’s Chicago May figure fell to 40.4 from 48.6, thus well under the breakeven of 50. As I don’t have the press release yet I have no details on the internals. Expect another below 50 print in tomorrow’s ISM manufacturing index and which if the case would be the 7th straight month.

Chicago PMI

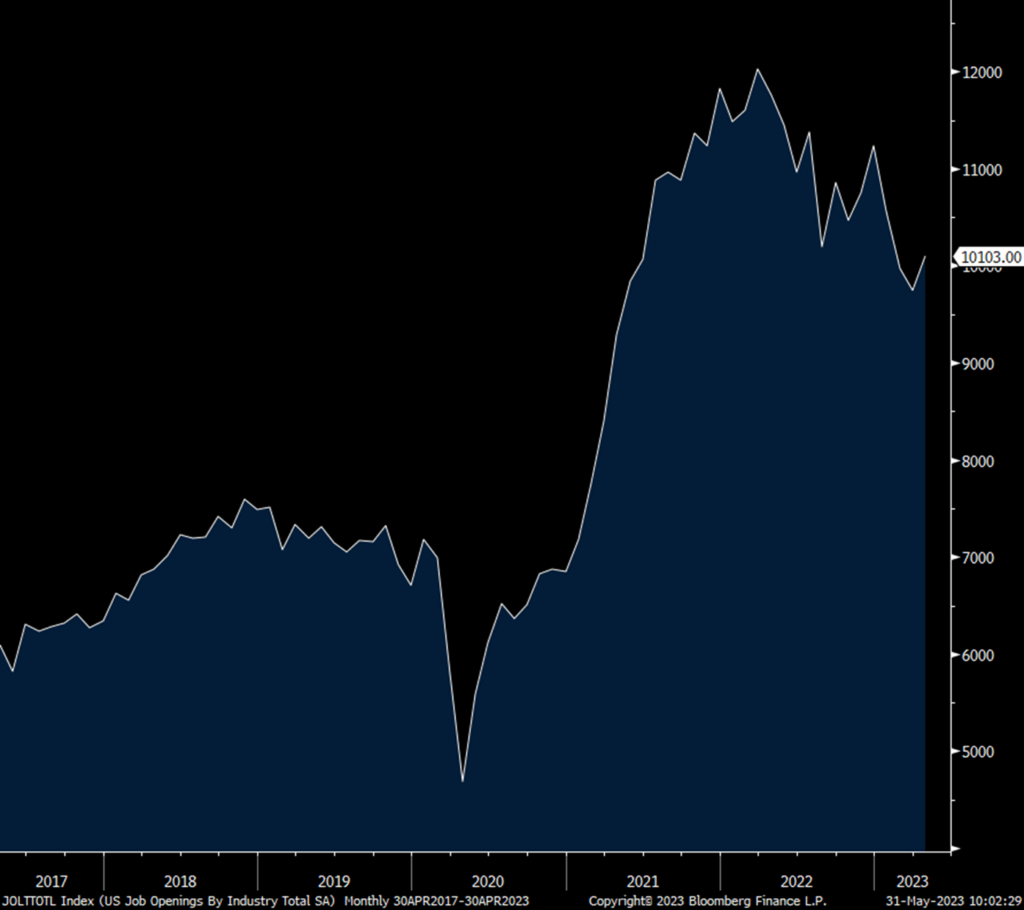

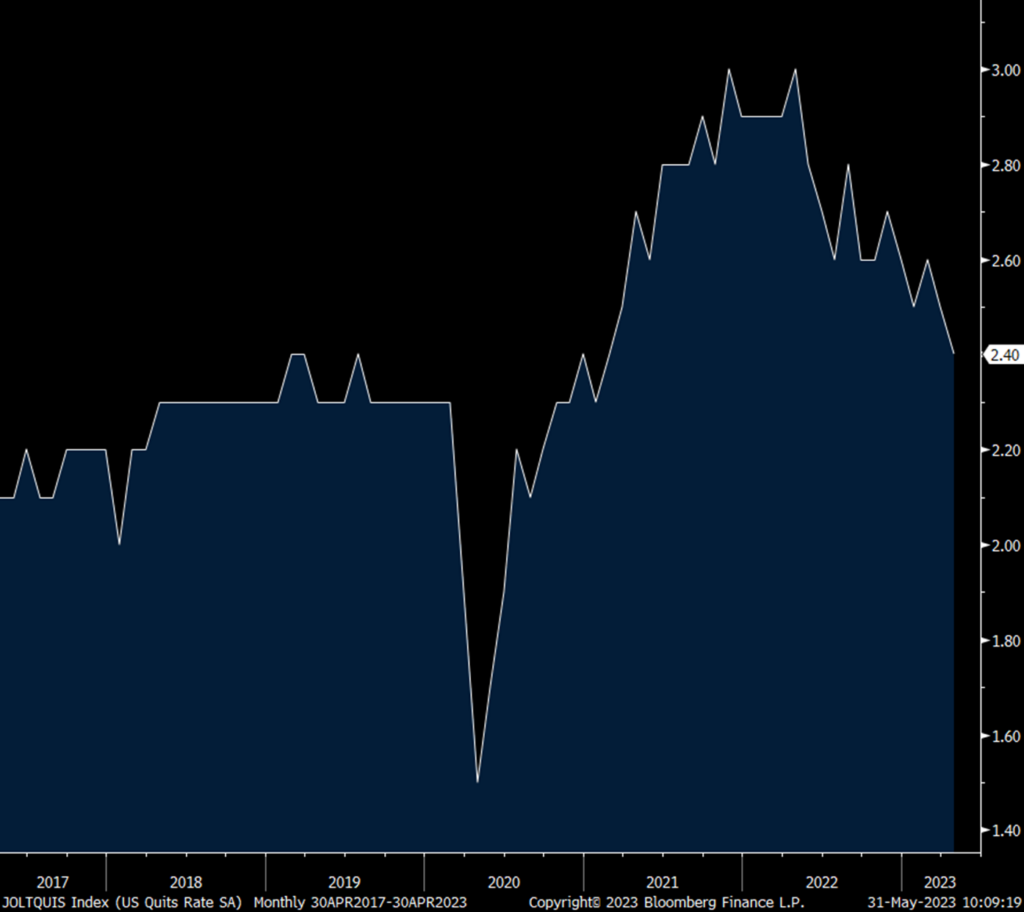

Job openings in April rose to 10.1mm and that’s up from 9.75mm in March (revised up from just under 9.6mm). The hiring rate though remained unchanged at 3.9% and noteworthy, the quit rate fell to 2.4% from 2.5% and that is the lowest since January 2021.

After falling in March, job openings picked up in construction (likely more demand from some of the big builders). Manufacturing job openings did fall to the lowest since February 2021. There was a jump in demand for retail workers and in transportation but openings for leisure/hospitality, which was the big demand spot over the past few yrs post Covid, continues to shrink as they fell to the lowest since April 2021. Not surprisingly job openings for real estate/rental/leasing fell but did rise for finance/insurance. Demand for education/healthcare workers remains consistent.

Bottom line, I know this is a big focus of everyone but it’s very dated and the trend is still for a lesser amount of openings as this April figure compares with the 2022 average of 11.17mm. Yields did rise in response to the upside surprise. Friday’s estimate for the May BLS payroll report, and thus more timely, is for a job gain of 195k which would be the 2nd month in 3 below 200k which was last seen in late 2019 pre Covid.

The economic outlook is pretty damn cloudy with a huge amount of confusion on what happens from here but if I had a dollar for every time I heard ‘challenging macro economic environment’ from companies in their quarterly calls I’d be able to buy a sports team. Point here is the Fed should show some humility too in not being so confident on how things play out in the coming months and if the case would mean a time out on rate hikes until we can gain some clarity. After all, there is another meeting in July, and in September, and yes in November and December too if they choose to keep on hiking. I’m not telling them to back off from their inflation goals but skipping a meeting doesn’t mean they have to.

Job Openings

Quit Rate

END

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.