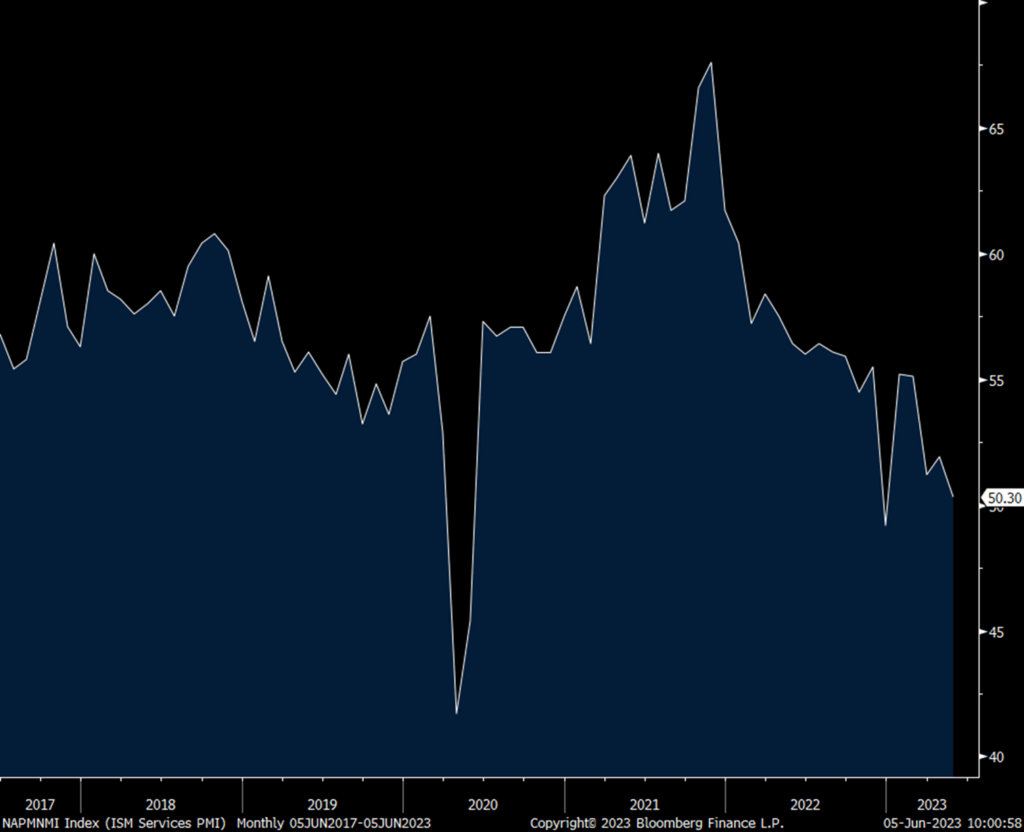

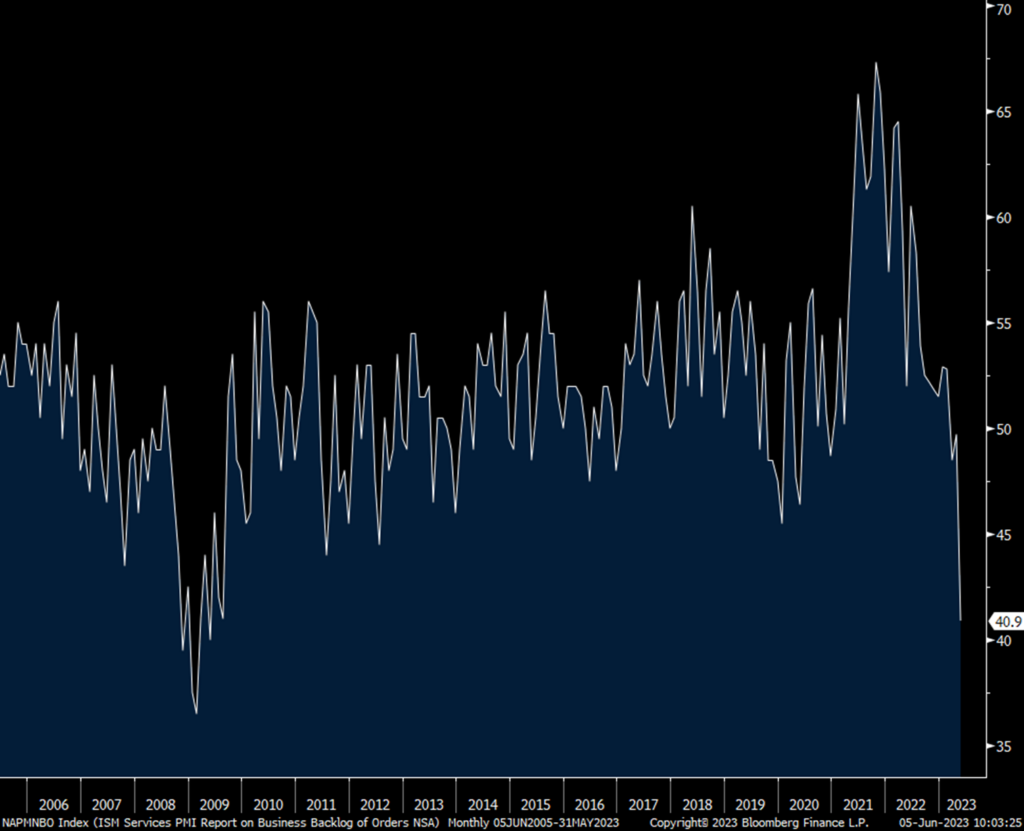

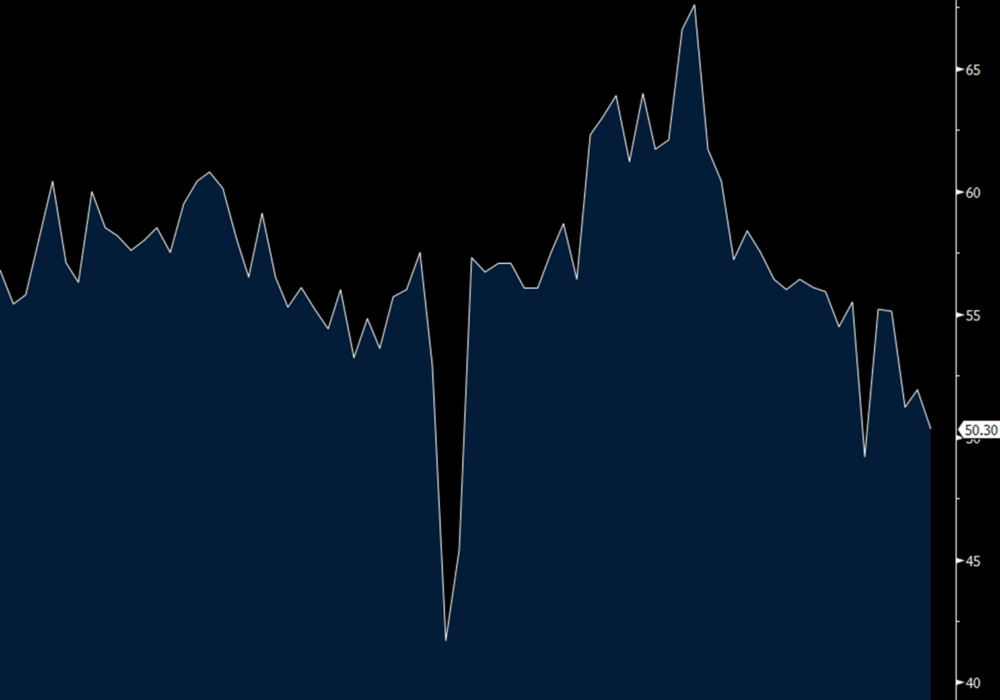

The May ISM services PMI unexpectedly fell to just above 50 at 50.3. That’s down from 51.9 in April and below the estimate of 52.4. New orders fell by 3.2 pts m/o/m to 52.9 and backlogs shrunk to just 40.9, down a large 8.8 pts m/o/m. Go back to May 2009 the last time we saw a weaker number. Inventories rebounded by 11.1 pts to 58.3 and that is the most since February 2021 which combined with the plunge in backlogs assumes that backlogs might have further to fall before new orders pick up (58% of service companies have inventories as the balance either don’t have any or don’t measure them). Supplier deliveries continued to retrench, highlighting the continued ease of supply chain constraints. Prices paid fell 3.4 pts to 56.2, the lowest in 3 yrs.

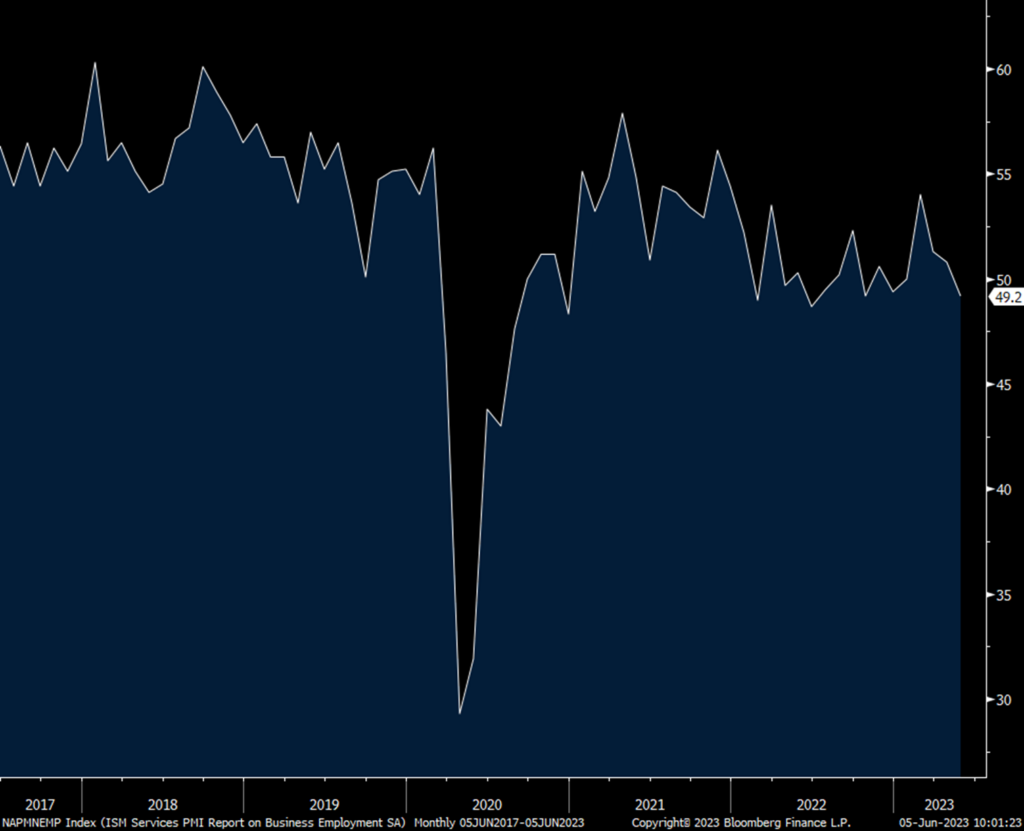

In contrast to the blow out establishment payroll report, the employment component fell back into contraction at 49.2 from 50.8 and that matches the lowest since June 2022. Only half of the 18 industries asked saw a rise in employment. Some quotes on hiring include: “We are trying to do more with the same staff because margins in the industry have compressed” and “Our company is currently on a hiring freeze until there’s a better understanding of where the economy is headed.”

Industry breadth deteriorated too as only 11 industries saw growth of the 18 surveyed. That compares with 14 in April. Seven saw a contraction vs 3 last month.

ISM bottom lined the report by saying “There has been a pullback in the rate of growth for the services sector. This is due mostly to the decrease in employment and continued improvements in delivery times and capacity, which are in many ways a product of sluggish demand. The majority of respondents indicate that business conditions are currently stable; however, there are concerns relative to the slowing economy.”

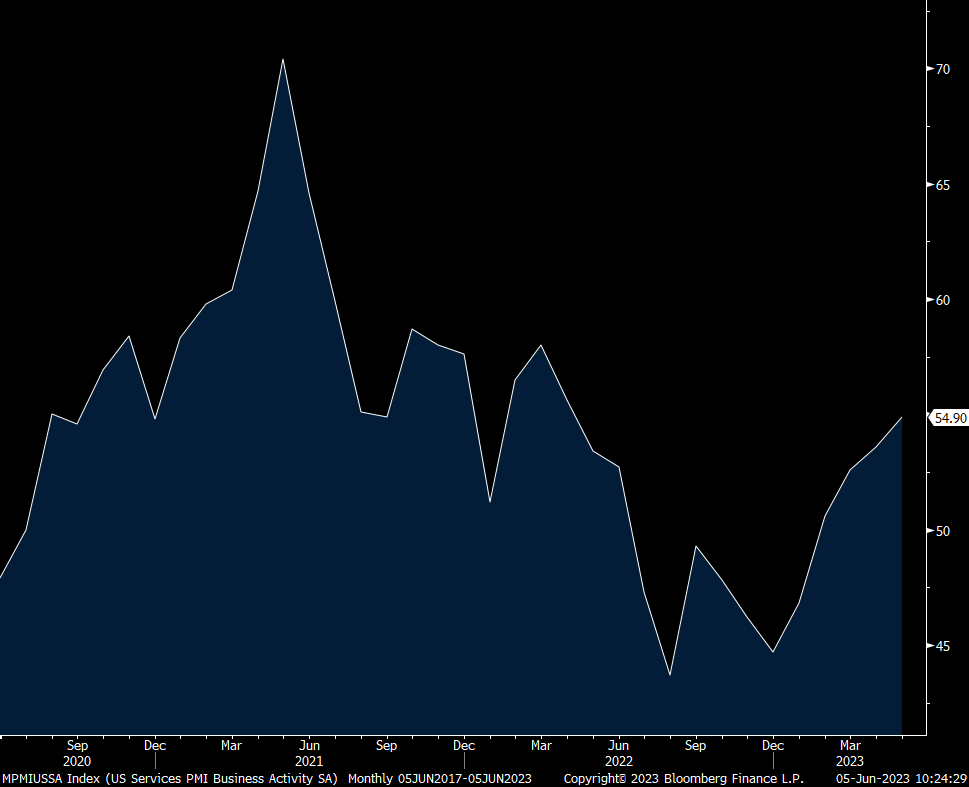

While this report was soft, we can thank the S&P Global services PMI in confusing the picture, though the latter doesn’t include ag, mining, utilities, construction, retail and wholesale trade while the former does. Also, S&P Global includes more small and medium sized businesses. The PMI rose to 54.9 from 53.6 and S&P Global highlighted particular strength, which we’re well aware of, in “travel, tourism, recreation and leisure.” The employment component was higher.

The net result in the Treasury market was for it to believe the ISM and that’s why yields fell immediately after the print. The 2 yr yield is back below 4.5% and the 10 yr is back under 3.70%. Rate hike odds in July went from 84% to 68%.

ISM Services

Employment

Backlogs

S&P Global US services PMI

END

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.