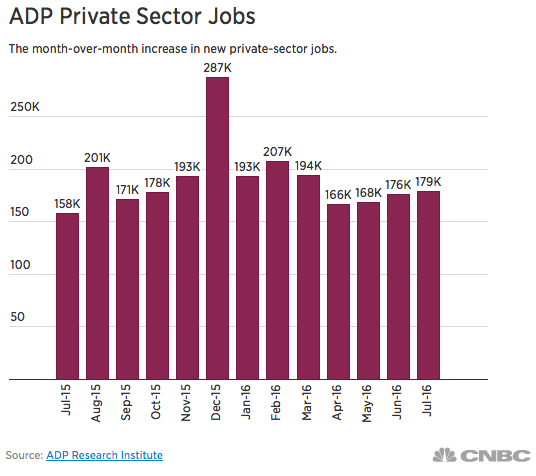

Initial jobless claims rose 3k w/o/w to 269k which was 4k above the estimate. As a 254k print dropped out of the 4 week average, the new 4 week average rose to 260k from 257k. Continuing claims, delayed by a week, fell 6k after rising by 12k last week. Bottom line, ahead of tomorrow’s July payroll report, the pace of firing’s remains modest for the reasons we’ve known for a while. And we’ve learned too that a benign pace of firing’s doesn’t contradict a slowing rate of job growth. As I also stated yesterday within the ADP summary, we must watch out to see if a slowing rate of profit growth and a shrinkage in margins will at some point have an impact on hiring intentions. Tomorrow’s estimate is for 180k. I’m taking the under to something closer to the 3 month average of about 150k.

Not only did the BoE cut interest rates by 25 bps as fully expected, they expanded sovereign QE by 60b to 435b from 375b pounds and they are adding a corporate bond buying program but that is modest, just 10b pounds over the next 1 ½ years. They also added a short term lending program for banks to cushion the impact of low rates. The vote was 9-0 to cut rates but there were 3 dissents on sovereign QE and 1 on the corporate bond buying. As to be expected the pound is getting hammered and gilts are spiking higher with the 10 yr falling by 16 bps. Their 2s/10s spread is narrowing by 4 bps to the lowest in 8 years. Sorry banking system.

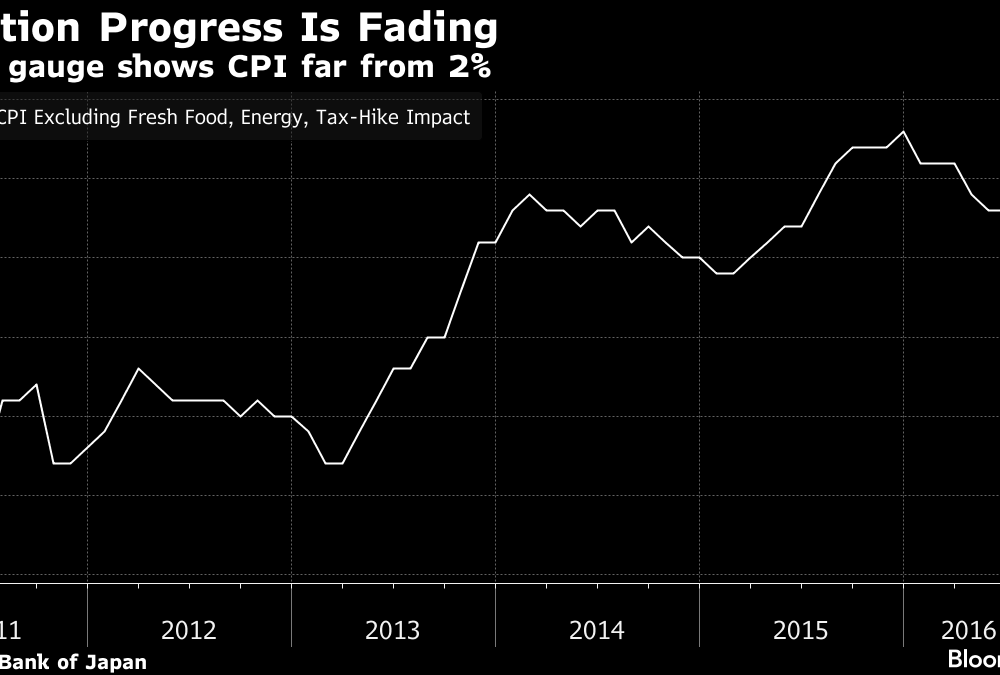

Bottom line, the BoE is now falling further into the same trap as the Fed, BoJ and ECB and for some reason hoping to see a different result. An even lower cost of money is not going to change any behavior but at the same time an ever flatter yield curve will further damage bank profitability. Pension funds, insurance companies and savers will be further starved for returns. Unfunded pensions will suck further funding from corporations away from growth initiatives. Further down the line, as the Fed is experiencing now, how does the BoE expect to get out of this. I thought for a moment that maybe Mark Carney was different than his peers but he today has proven that he is just the same as the others in believing too highly of the abilities of central banks to generate economic growth and showing no sense of humility about their effectiveness. Creating asset bubbles is their only real skill set.

The Markit eurozone retail PMI for July rose a touch to 48.9 from 48.5 in June. It does mark the 7th month in the past 9 being below the breakeven of 50. Markit said “While German and French retailers are enjoying periods of steady sales growth, their counterparts in Italy have endured back to back steep decreases in sales of the likes not seen for over 2 ½ years.” Both the German and French indices are above 50 while Italy’s is down at 40.3. In terms of overall pricing, “purchase price inflation quickens slightly from June’s 16 month low.” If the ECB is successful in generating higher inflation, retail sales in the region would only worsen.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.